COVID-19 has marked 2020 by altering everyone’s daily life. Its effect has been devastating in the health field, and the direct economic consequences are already noticeable, leaving great uncertainties of its medium and long term effects.

If we try to analyze the impact that this health and economic crisis will have on the mergers and acquisition transactions in Spain, it is interesting to revise what the prospects were before the start of this crisis.

At the beginning of 2020, most professionals in the sector were certainly optimistic about the favorable expectations of an increase in M&A transactions compared to 2019.

At that time, entrepreneurs and managing directors stated that their main motivations when generating M&A operations were access to new markets or clients, their international development or divestment operations to generate liquidity.

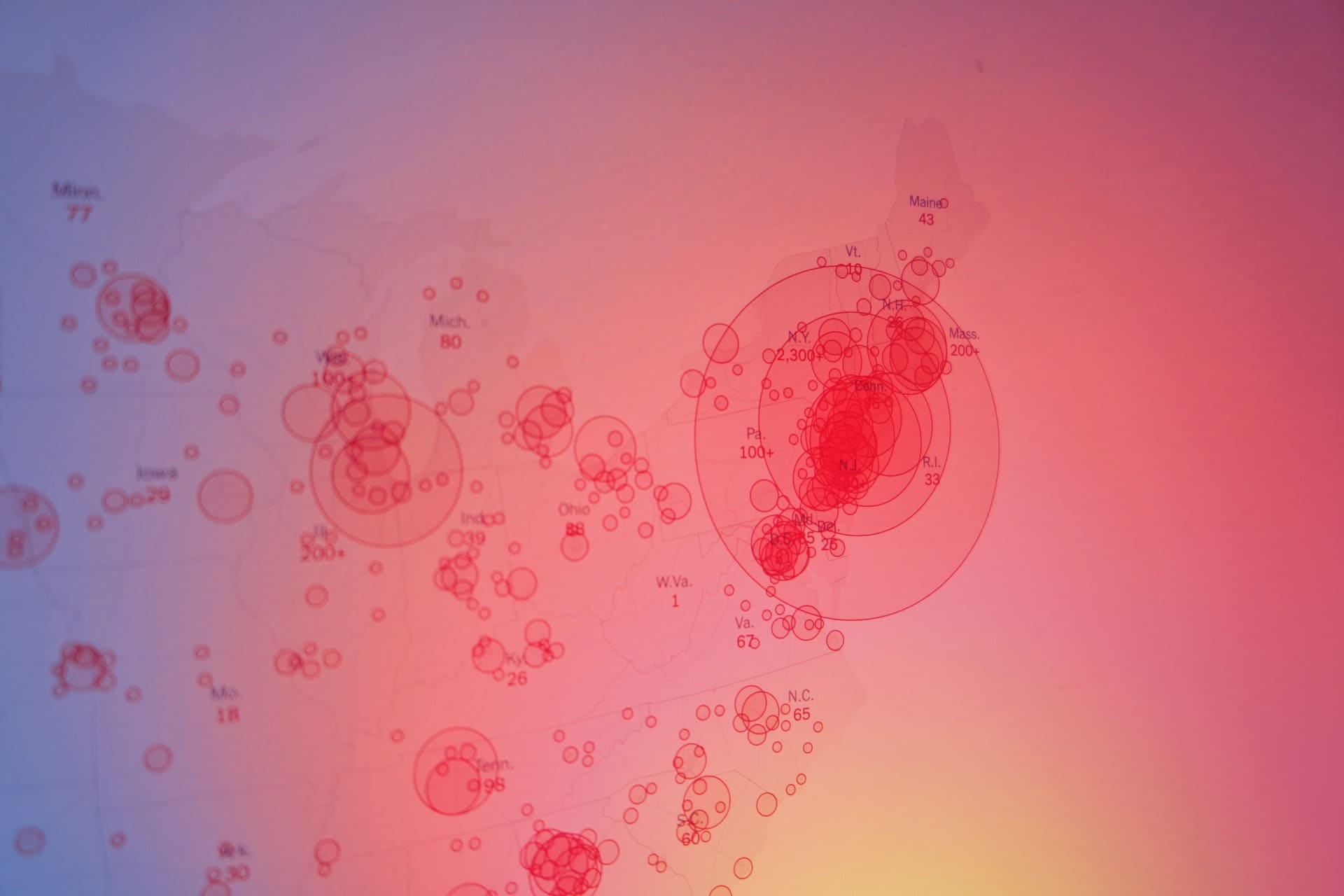

However, despite these bright expectations, the reality was very different. According to data provided by TTR, the volume moved by these operations from January to March 2020 fell to 8,022 million euros, 59% less than in the same period of the previous year, although by number of operations, the fall was lower, with 465 transactions, and a fall close to 20% compared to 2019. Without a doubt, the effect of the coronavirus was noticeable with the paralysis of numerous operations, quantifying this break in about 12,000 million of euros.

In March, virtually no operations were carried out, even those that were underway and about to be ratified were halted, given the difficulties generated by the state of alarm and the restrictions attached.

At UHY Fay & Co we managed to complete a successful international transaction which should have been ratified with a face-to-face signature in the country of destination of the acquisition but was finally carried out online since travelling was impossible at the moment.

The slowdown was accentuated by the fact that the Spanish Government shielded most of the listed companies in the country to avoid foreign investors taking advantage of the sharp drop in their share price.

Although, in general, the fall in M&A operations is clear, of the three options available, purchases from abroad, foreign and national purchases by Spanish companies, the latter, according to Mergermarket data, and with a volume of 2,641 million in the first quarter In Spain and Portugal, not only have maintained a strong activity, but are higher than the quarterly average registered in 2017, 2018 and 2019. This indicates that, although operations abroad have been paralyzed, and this has also happened internationally, companies have strengthened domestic transactions.

After the confinement, and once a situation of certain normality has been reached, many articles and opinions of experts predicting a new boom in operations of M&A were published, given the high volume of liquidity that exists in investment funds, and the foreseeable financial problems that entities of all types and sectors are facing.

However, this return to activity, and how it is happening at a general level, is surrounded by several uncertainties. In addition to the already complex task of obtaining an objective valuation of a company, there is also the difficulty of assessing whether, for example, the impairment of assets in the current situation is temporary or structural.

Mergers and Acquisitions operations require comprehensive advice due to their complexity, high degree of specialization and, in many cases, international nature.

UHY Fay & Co’s way of understanding this practice is focused on the client, identifying their needs and accompanying them throughout the process, offering a personalized service and helping to overcome internal and external barriers. For this, it has a team made up of specialized professionals with extensive experience in all legal, financial and tax disciplines that require this type of process.

For over 15 years we have helped many different companies to expand nationally and internationally ensuring that its investments are made with maximum guarantees.

Eva Martín de Pozuelo

emg@uhy-fay.com

Javier Bahut Vega

jbv@uhy-fay.com