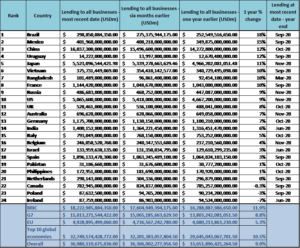

Spain increased bank lending to businesses by only 3% during Covid – falling behind 5.3% increase of EU countries

- Spain added USD31.3 of business loans in past twelve months

- Lending rises by 3 trillion across 24 major economies

- More help is needed as countries continue lockdown restrictions

Bank lending to businesses in Spain has increased by only 3% since the Covid-19 pandemic, falling behind other EU countries reveals a new study by UHY, the international accounting and consultancy network*.

European countries increased lending

European countries increased lending by an average of 5.3% versus 10% globally – suggesting Spain may need to do more to support businesses through the pandemic.

UHY’s study of 24 major economies shows banks in Spain provided USD31.3 billion of additional lending to businesses in the last twelve months. UHY says Spain’s economy could have performed better if banks had provided more funding to small businesses during the pandemic. This is because Spain’s economy is highly dependent on SMEs and businesses in sectors such as tourism which have been devastated by international travel restrictions.

UHY’s study found that banks in Spain wrote less new lending to help businesses during the pandemic than other major European economies such as France (10%) and UK (8%).

Spain’s economy has been one of the hardest hit by the pandemic, with an 11% fall in GDP last year**, worse than other countries in the region including the UK (10.1%) and Italy (10.5%).

The Government has provided EUR100 billion worth of loans to small and medium sized firms under its ICO (Official Credit Institute) scheme. However, this only represents around 9% of GDP, less than its European peers. This scheme has been extended till June 2021 but a lot of the damage has already been done to struggling businesses.

Antonio Gamero, director of the audit department at UHY Fay & Co says: “Spain hasn’t moved quite quickly enough to provide the level of funding necessary for businesses to comfortably weather the pandemic. With such a large hospitality and tourism sector the demand for attractively priced emergency loans is definitely there.”

“The news of a vaccine provides a light of the end of the tunnel. But with many businesses still not able to return to ‘normal’ operating levels, Spain needs to provide as much support as possible to ensure businesses stay afloat until then.”

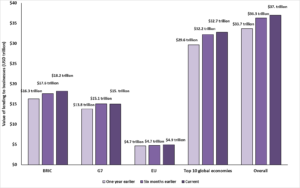

Outstanding lending to businesses across the ten biggest global economies hit a total of USD32.7trillion last year, an increase of USD3.1trillion (10.5%), compared to USD29.6trillion of outstanding loans a year earlier.

UHY’s study found that BRIC countries experienced a particularly large increase in bank lending in the last year, adding USD1.93 trillion – a 12% increase on average.

BRIC countries outpaced the G7 (9% growth in lending on average), adding an extra USD1.2trillion to outstanding loans, reaching a total of USD15trillion last year.

Spain has only increased bank lending to businesses by 3%, compared to 5.3% increase across EU countries