The corporate tax in Spain, above the European average, calls into question the competitiveness of our country compared to others that are more attractive from a tax point of view.

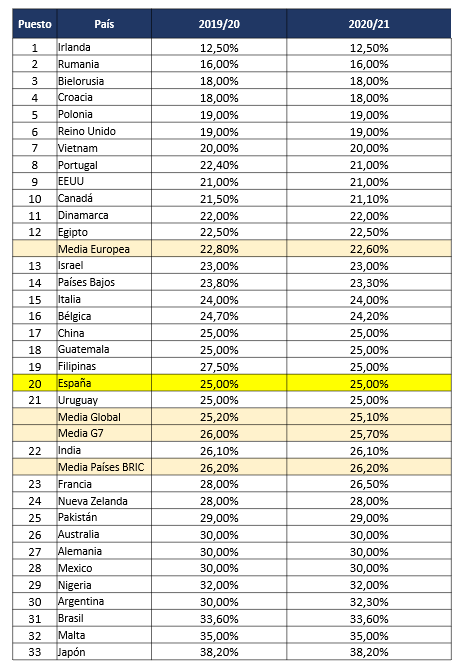

Spain’s corporate tax rate of 25% is markedly above the European average of 22.6%* as concerns grow that rising taxes could make the country less competitive for business, shows a new study by UHY, the international accounting and consulting network.

There is pressure on Spain to increase the taxes that it levies in order to pay for the cost of Covid- related support that the Government provided to the economy during the pandemic.

UHY says that given Spain’s corporate tax rate is already above the European average, the Government should look at other taxes first before deciding to raise corporate tax rates.

Spain’s corporation tax rate has been at 25% since 2016. This rate applies to all corporates, apart from new businesses, which incur a rate of 15% on profits made in their first two financial years.

Inmaculada Domecq, Partner at UHY Fay & Co, UHY’s member firm in Spain, says that given Spain’s corporate tax rate is already above the European average, the Spanish government should look at other taxes first before deciding to raise corporate tax rates.

Says Inmaculada Domecq, “As the pandemic ends Spain is looking at how we are going to pay the bill. The government deferred a lot of taxes in order to help businesses manage the stresses of the pandemic and spent heavily to keep the economy going.”

“We understand taxes may need to rise, but considering Spain is already above the European average for corporation tax, increases in corporate tax may not be the best answer.”

“Companies are still feeling the sting of the last two years, therefore a sensible corporate tax policy is crucial to help maintain business confidence. The higher the corporation tax rate, the less businesses have to reinvest in expansion, R&D and job creation.”

UHY says that the long period of declining corporate tax rates globally appears to be ending as many governments worldwide look to increase taxes on business to help pay for the costs of the pandemic. Countries including the UK and Argentina have already announced measures to increase taxation of corporates, while US President Joe Biden has also signalled his intention to roll back part of the corporate tax cut implemented by Donald Trump in 2017.

OECD’s global minimum tax rate may prevent further tax rate cuts

The OECD announced in October that 136 countries have signed up to a deal to enforce a minimum corporate tax rate of 15% from 2023. The deal will also allow countries to tax multinationals that make sales within their jurisdictions even if they do not have a physical presence there.

As a result of growing political pressure, some lower-tax jurisdictions will likely now have to increase their corporate tax rates for multinationals. Countries such as the Republic of Ireland have come under fire for their low corporate tax rate of just 12.5%.

These corporations are a key target for government clampdowns worldwide, with some multinationals choosing to operate from lower-tax countries, resulting in them recording lower profits in higher-tax countries.

CORPORATE TAX IN THE DIFFERENT COUNTRIES ANALYZED

RELATED SERVICES:

– Tax advisory

– International Tax