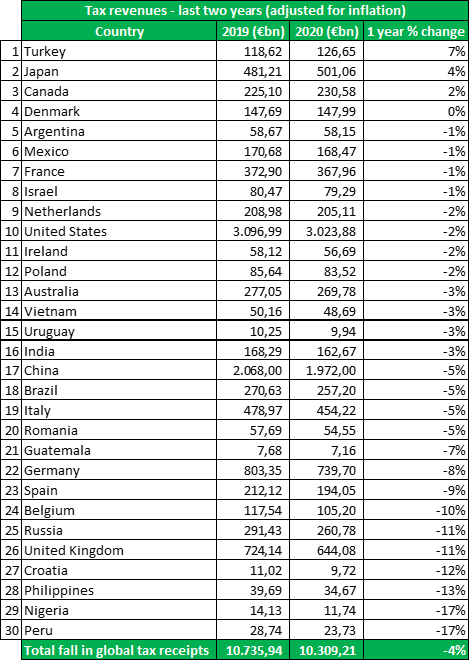

Tax receipts in Spain drop by over €18bn during pandemic 26 out of 30 countries suffer a fall in tax revenues

- Post-pandemic rebuild plan sees tax rates rise for many

- Global tax receipts fell €400bn

Tax receipts in Spain have fallen by more than €18bn reveals a new study of tax revenues worldwide by UHY, the international accountancy network.

The fall in tax revenue in Spain worked out at 9%, far faster than the global average of 4%. The study showed that global tax revenues fell by €400bn.

UHY says the fall in tax revenues is due to the Covid-19 pandemic, as governments cut taxes for individuals and businesses to boost their economies. In addition, tax revenues were hit by a fall in tax on corporate profits and a reduction in transactions that are subject to tax (e.g. VAT on purchases and tax on property transactions).

UHY’s study shows 26 out of 30 countries suffered from a fall in tax revenues in the last year. Some of the biggest decreases include the UK which saw tax revenues fall 11%* to €644,08M and Russia which also fell 11%* to €260,78M (see table below).

At the same time, governments increased spending as they introduced Covid support schemes to help those who were impacted by the pandemic. For example, Spain’s ERTE job retention scheme (which provided employees with up to 70% of their salaries) and aid packages to safeguard economic stability. The additional costs of these measures impacted the public purse significantly.

The Spanish government has pushed forward with tax rises to address the fall in revenue. National income tax for those earning over €300,000 has increased by 2% (from 45% to 47%), the national marginal tax rate for the wealthiest has increased by 1% (2.5% to 3.5%)** and proposals have been considered to enact a minimum 15% corporation tax for large companies.

Other countries have also already begun implementing tax increases, such as the UK, which recently increased National Insurance contributions, generating an extra €17M per year.

Inmaculada Domecq, Tax partner at UHY Fay & Co, comments: “The Spanish government provided much needed economic support throughout the pandemic helping to protect key sectors such as tourism and hospitality. However, the challenge is to consolidate the economic recovery while still suffering the pandemic with a new wave that is affecting the whole world. The government has already started to take action by bringing forward a range of measures to strengthen public finances, including raising certain taxes. However, caution will be needed to ensure that any future tax increases do not dampen business investment or consumer confidence.”

Tax revenues of major economies take a hit during Covid

Germany’s tax revenues fell 8%* to €739,70M in 2020. During the pandemic the German government introduced a number of tax cuts in the hope of boosting the economy. The standard rate of VAT in Germany was reduced from 19% to 16% last year. Businesses in the catering sector, arguably one of the sectors that suffered the most from Covid-19, benefited from an even bigger reduction in VAT from 19% to 7% on food sales.

Another major economy that suffered from a fall in tax revenues was China, falling 5%* to €1.9bn last year. China recognised the impact of the pandemic on smaller enterprises and as a result, introduced several tax reliefs focused on supporting these businesses. An example is the significant reduction in Corporate Income Tax, which for small and micro enterprises with a tax income below RMB 1 million, was reduced from 25% to 5% last year. In 2021, it was announced this rate would be cut even further to 2.5%.

Other countries experienced significant variations in their tax receipts this past year. Most notably, Turkey saw its tax receipts increase by 7%. By contrast, the Philippines saw its tax receipts fall by 13% in real terms, and Nigeria, the largest economy in Africa, tax receipts experienced a fall of 17%.

*Adjusted for inflation

** Applicable to those with net wealth exceeding €10,695,996