Merger and Acquisition (M&A) operations require comprehensive advice due to their complexity, high degree of specialization and, in many cases, international character.

There are different reasons why a company may be at the perfect time to embark on this type of transaction, although this will not be the object of this article.

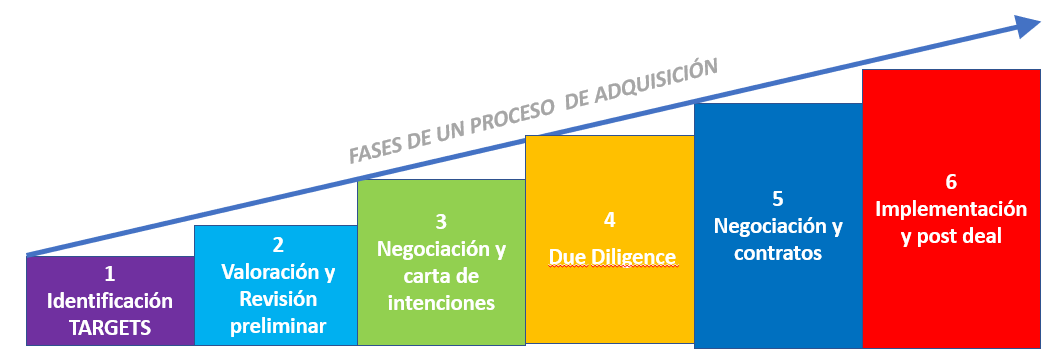

We want to focus on making a simple description of the different phases that take place once an operation of this nature starts, assuming that we are the entity interested in making an acquisition and emphasizing the key aspects for its success.

As a common note to all processes of this nature, we want to emphasize that, in our experience, mutual trust between the parties involved is essential to successfully close an acquisition and, therefore, it is very important to agree on the steps to follow from the beginning.

1. Identification of potential targets (target company)

In this phase, an analysis of the market and the companies that fit the profile sought will be carried out. Once the selection has been made, the first contacts with the target companies will take place. Once there is interest by the parties, a preliminary analysis of the selected targets will be carried out in order to identify those that fit with the entity’s growth strategy.

2. Assessment and preliminary review

Once the target company has been identified, we would enter the next phase of the process where the business valuation will be carried out. This valuation exercise is essential for subsequent negotiation.

In this phase, an in-depth analysis of the financial information provided by the company to be acquired is carried out, so that potential risks or possible inconsistencies can be identified. This detailed analysis provides a consistent valuation basis.

3. Negotiation and letter of intent (LOI)

Once the assessment has been carried out, we proceed to prepare and negotiate the Letter Of Intent (LOI).

For this purpose, it is important to take into account the particularities in which the operation is framed, if the target company offers additional strategic value for our company, or if we are aware that it has offers from third parties. The conclusions drawn from the valuation phase are also relevant, as it allows us to know the expectations of the seller of the business.

Considering these issues, among others, the letter of intent will be negotiated. This letter of intent stipulates the framework of common understanding for the signing of the subsequent contract. The letter of intent does not have to be binding.

It is essential to draw up a LOI as adjusted as possible to the real scenario of the operation and setting the appropriate limits to contribute to the success of the operation.

4. Due Diligence

It is an exhaustive process which purpose is to verify that the information received is correct and that the offer proposed in the LOI is adequate. A due diligence can generate adjustments to the LOI.

A due diligence covers all fields that affect the business: financial, commercial, legal, labor, and tax aspects; verifying, for example, contracts with clients, to check if there is any dispute to be resolved, or aspects related to intellectual property.

It is, therefore, a key process that must be undertaken rigorously. This process is fundamental to verify, and confirm, that the information used to carry out the assessment and preliminary agreement is consistent. In addition, it will allow the buyer to have a comprehensive vision of the business and detect possible risks, synergies, and opportunities.

5. Negotiation and sale contract (SPA):

The negotiation and signing of the Sale and Purchase Agreement (SPA) contract takes place in the final phase of the process. This contract will regulate the terms of the transaction (type of operation, price, payment method, obligations, guarantees and representations, among others).

It is usual in this type of operations to use the so-called “earn-out payments”, which consist of payments to be made once the acquisition is completed, normally conditioned to the fulfillment of milestones established by the parties on the evolution of the business in the future.

It is also possible that a security deposit is required to be able to deal with potential contingencies. The amount of the guarantees and the period of validity of the same are fixed in the sale contract.

There are many aspects that this contract has to cover, depending on the type of operation and the sector, a contract of this nature can be highly complex. That is why it is essential to have an expert legal advice team that has been involved throughout the process and knows the transaction well.

6. Implementation and post-deal

Once the acquisition is completed, the integration of the acquired company begins. This is a delicate moment that must be carried out properly to make the operation a total success. It is important to have a plan in place with objectives to be met in the short and medium term and, without a doubt, to take into account the human factor of all organizations, which will play a key role.

In the same way, monitoring the integration for legal and financial purposes is essential to monitor compliance with the agreed terms.

Eva Martín de Pozuelo

Corporate Finance Manager

emg@uhy-fay.com

Javier Bahut Vega

Business Development Manager

jbv@uhy-fay.com